ID ITD 3425 2013 free printable template

Show details

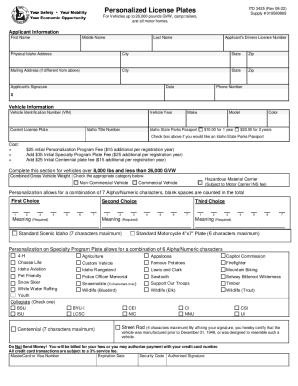

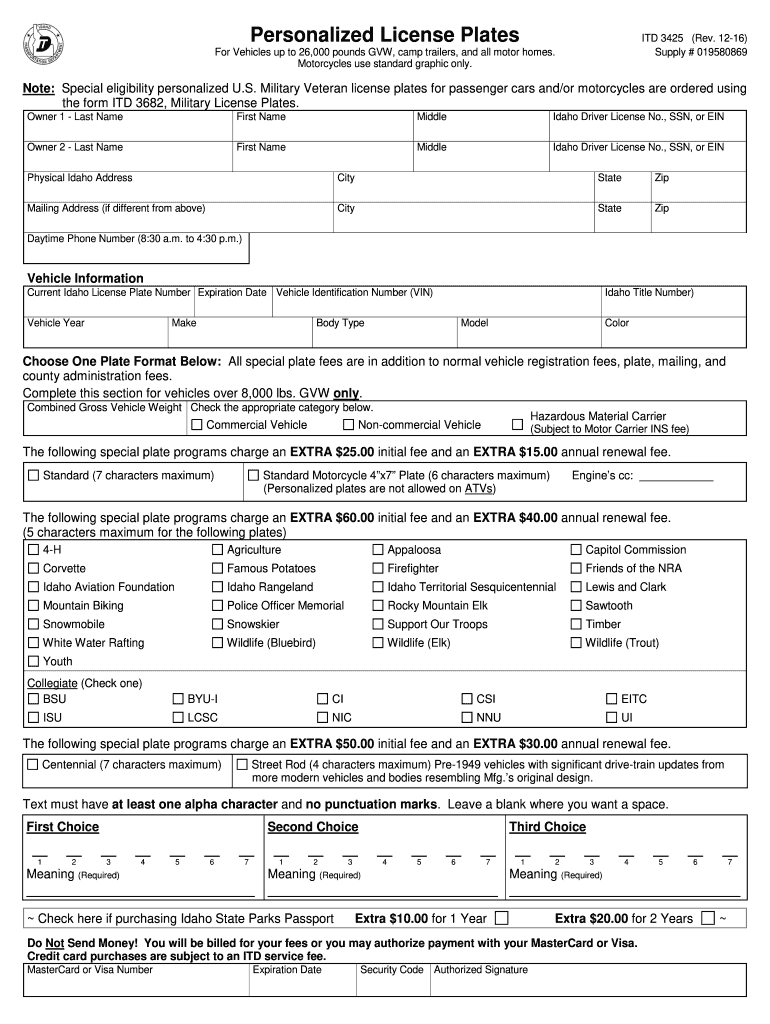

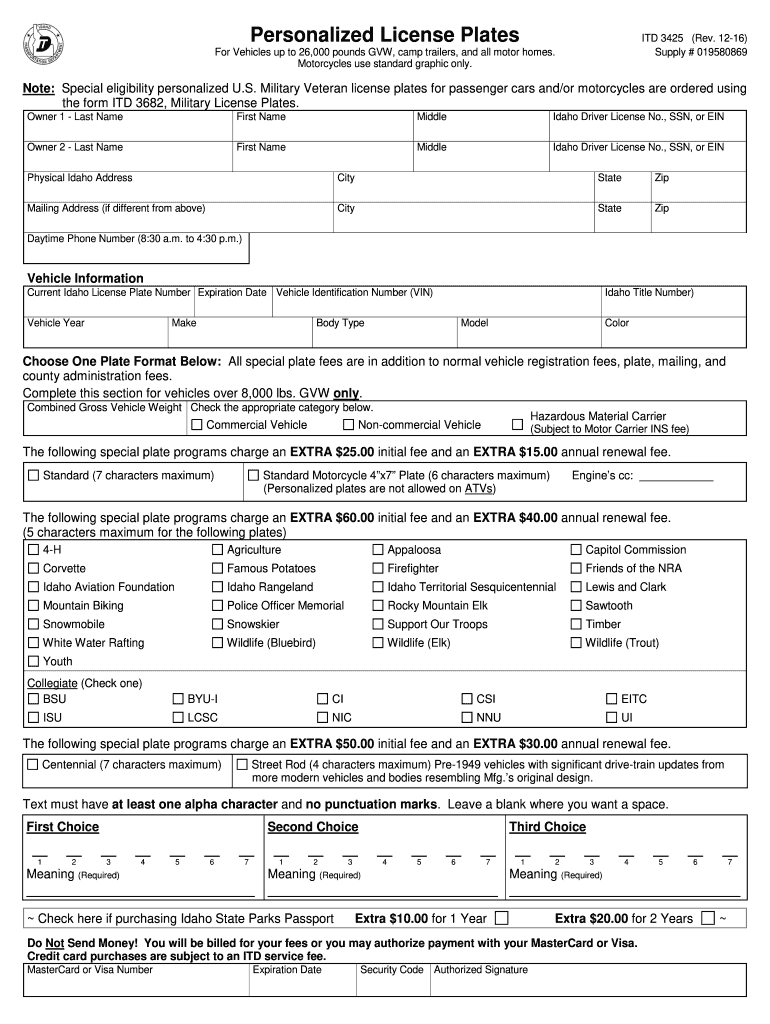

Personalized License Plates ITD 3425 Rev. 01-15 Supply 01-958086-9 For Vehicles up to 26 000 pounds GVW camp trailers and all motor homes. Motorcycles use standard graphic only. Note Special eligibility personalized U.S. Military Veteran license plates for passenger cars and/or motorcycles are ordered using the form ITD 3682 Military License Plates. Owner 1 - Last Name First Name Middle Idaho Driver License No. SSN or EIN Physical Idaho Address C...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID ITD 3425

Edit your ID ITD 3425 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID ITD 3425 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ID ITD 3425 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ID ITD 3425. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID ITD 3425 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID ITD 3425

How to fill out ID ITD 3425

01

Begin by downloading the ID ITD 3425 form from the official website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide your identification number or Social Security number where required.

04

Complete any relevant sections that apply to your situation, such as employment details or financial information.

05

Review the form for any missing information or errors before submitting.

06

Sign and date the form as indicated.

07

Submit the completed form as per the instructions provided, either online or via mail.

Who needs ID ITD 3425?

01

Individuals who are applying for specific government services or benefits that require identification verification.

02

Persons seeking to update their identification records or apply for a replacement ID.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to get a custom license plate in Idaho?

These special plates can also be personalized with up to five letters and/ or numbers. The cost to personalize these plates is $25 in addition to both the special program fees and all other required annual registration and plate fees. The renewal fee for a personalized plate is an additional $15 per year.

How long does it take to get personalized plates in Idaho?

Standard Sized Plates (6” x 12”) - Approved personalized license plates will generally take a minimum of 3 weeks for delivery after fees have been received. A temporary registration may be available.

What are the custom license plates rules in Idaho?

Personalized plates, in any language, may not carry a sexual term that is vulgar, obscene, or in poor taste, and may not consist of a term that is considered to be one of obscenity, contempt, prejudice, hostility, insult, racial degradation, ethnic degradation, profanity, or vulgarity.

What is required to register a vehicle in Idaho?

Before you can register or title your vehicle, you will need to provide either your Idaho driver's license number, Idaho ID card* number, or social security number (SSN), or your individual taxpayer identification number (ITIN), along with your full legal name and physical address, and mailing addresss if different.

How much does it cost to register your vehicle in Idaho?

The age of the car and your county of residency are additional factors that determine the registration fees. You have to pay anything between $45 and $69 to get a car registered in Idaho.How much does Idaho vehicle registration cost? Age of the vehicleRegistration fee1-2 years$693-6 years$577 years and above$45

How do I register my out of state vehicle in Idaho?

(You can apply for vehicle registration immediately after the titling process has been completed.) Out of State vehicles, registering for the first time in Idaho, must bring vehicle to DMV for a VIN inspection. You must provide your Idaho Driver's License number or Social Security number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my ID ITD 3425 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your ID ITD 3425 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit ID ITD 3425 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share ID ITD 3425 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete ID ITD 3425 on an Android device?

On Android, use the pdfFiller mobile app to finish your ID ITD 3425. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is ID ITD 3425?

ID ITD 3425 is a tax form used for reporting specific income or tax information to the tax authority.

Who is required to file ID ITD 3425?

Individuals or entities that have income or tax information that needs to be reported, as specified by the tax authority, are required to file ID ITD 3425.

How to fill out ID ITD 3425?

To fill out ID ITD 3425, gather financial information, complete the required fields accurately, and ensure all necessary documentation is attached before submitting.

What is the purpose of ID ITD 3425?

The purpose of ID ITD 3425 is to report income or tax-related information to ensure compliance with tax regulations.

What information must be reported on ID ITD 3425?

The information that must be reported on ID ITD 3425 includes personal identification details, income earned, tax deductions, and any other relevant financial information as mandated by the tax authority.

Fill out your ID ITD 3425 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID ITD 3425 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.